Introduction

In Latina America, Argentina is the second largest country after Brazil. It covers an area of 2,780,400 km². The country has a population of about 42 million people. Argentina’s economy benefits from its natural resources, high literacy levels, an agricultural sector that is export-oriented, and a highly diversified industrial base. However, it is important to note that, during the 20th century, Argentina suffered from economic crises including high inflation rates, burgeoning external debts, high unemployment rates, and capital flight (Cohen, 2012). The 21st century has, however, is promising for Argentina’s economic growth albeit at a slow rate. This paper will look at Argentina’s inflation rate, its trend and the relationship to the economy.

The relationship between Argentina’s unemployment rate and inflation may refer to an increase in money supply or price levels. The inflation rate, therefore, would mean the rate at which price levels or money supply increase. Data of September 2015 shows that Argentina’s inflation rate stands at 14.5%. It is the lowest recorded inflation rate for the country since December 2013 (Lopez, 2015). According to the National Statistics Institute (INDEC), it was caused by an increase in consumer prices in the month of September. In October 2015, Argentina’s inflation rate was 14.7%, mainly due to the increase in food and beverage prices as well as transportation costs. There is a relationship between the country’s inflation rate and its economic performance.

Get a price quote

Get a price quote

- Free bibliography page

- Free title page

- Free formatting (APA, MLA, Harvard, Chicago/Turabian)

- Free revision (within 2 days)

- Free from AI-written content

- 24/7 support

- Approx. 300 words/page

- Font: 12 point Times New Roman

- Double and single spacing

- 1 inch margin

- Up-to-date sources

- Any citation style

According to economists, Argentina’s economy is expected to record little or negative growth this year. However, there is an expectation that its economy is on a turnaround as investors are buying the country’s debts (CNN Money, 2015). With the inflation at 14.5 per cent, coupled with rising taxes, small businesses are getting hurt. The first relationship, therefore, is that the country’s high inflation is hindering the growth of small businesses. It is important to note that small businesses are the drivers of a country’s economy. The economic slump in Argentina’s economy has been caused by the fact that small businesses are losing their purchasing power as the prices of goods and services are very high (Lopez, 2015). Additionally, as small business owners in Argentina need to borrow from lenders to develop their businesses, high inflation prompts banks and other financial institutions to raise interest rates. This fact has made it difficult for small businesses to compete fairly with big businesses, which has caused slow economic growth in Argentina. This relationship between high inflation and slowed poor economy is the most evident in the inflation and economic growth trends over the last couple of years.

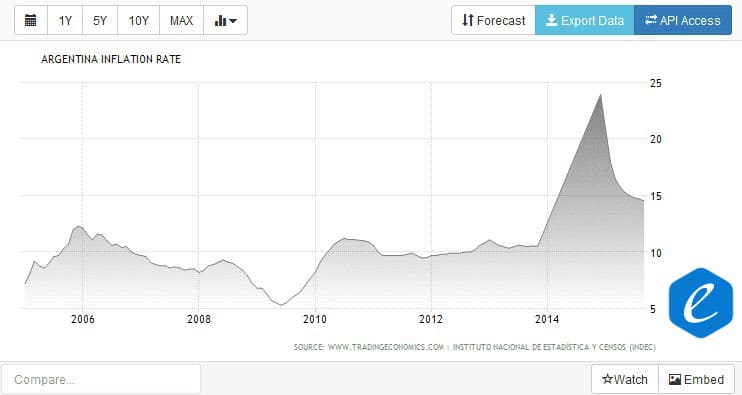

Figure 1. Inflation Rate in Argentina in 2006-2014

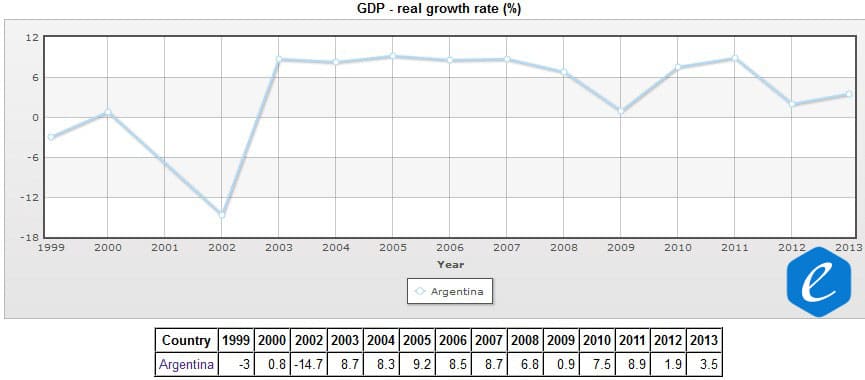

Figure 2. Economic Growth Rate in Argentina in 1999-2013

The data provided above clearly indicates that as inflation rates go high, Argentina’s economy begins to fall. However, when inflation is low, the economy begins to rise. Case in point, in 2008, as inflation was rising slightly there was a corresponding fall in Argentina’s economy.

The second relationship is that Argentina’s high inflation has led to a rise in the Merval stock market (CNN Money, 2015). This year, Argentina’s stock market has gone up 45% – more than Europe’s stock market’s excellent performance and considerably more than S&P 500. The reason for this rise in Argentina’s stock market is that the factors that have caused prices of goods and services to remain relatively high are the same factors that have raised the values of Argentine companies. The rise in value has, therefore, prompted these companies to raise employee wages. This increase is in turn passed to the consumer in the form of higher commodity prices as companies maximize on profits. A rise in stock market thus causes a rise in GDP and, consequently, high inflation. In Argentina’s scenario, the financial sector of the economy may be seen as growing. This growth is, however, generally very slow considering the fact that other sectors, such as the agricultural sector, are performing poorly.

Last but not least, there is unanimous agreement among economists that there exists a non-linear relationship between inflation and economic growth. However, the threshold effect may explain why a certain level of inflation can spur economic growth. In Argentina’s case, looking at Figure 1 and Figure 2, it is clear to notice areas where, as inflation was rising so was the country’s economy (Argentina Inflation Rate, 2015). This correlation may be referred to as the threshold effect of inflation on economic growth. In 2012, when the inflation rate was at 10%, Argentina’s GDP growth rate was almost at zero. On the other hand, 2009 data shows that inflation rate was considerably low at 5% consequently creating the right environment for Argentina’s economy to grow at a rate of 6% per year. It, therefore, shows if Argentina is to rely on inflation for its economic growth, policymakers must only allow inflation to reach a certain threshold. This threshold is to be determined by the country’s policymakers and economists.

Trends in the Data Set

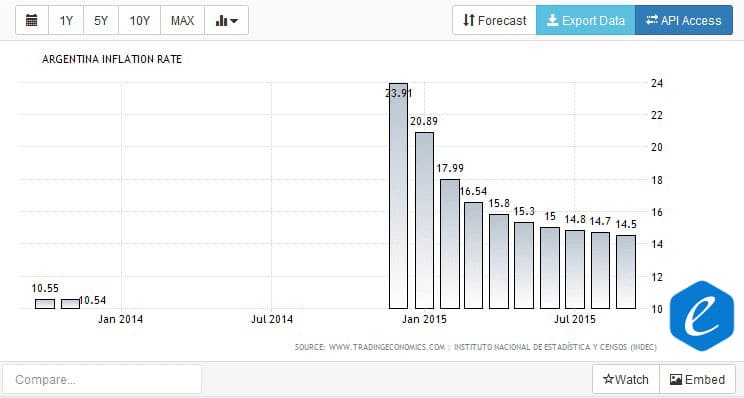

The data set provided for the last ten years shows a trend. Argentina’s economy has been growing steadily since 2005 except during the recession of 2008 that affected the whole world. However, the country has struggled to get out of this hole and coupled with its high inflation. Thus, little to negative growth in the economy is expected in 2015 and 2016. The data provided in Figure 3 shows a reduction in inflation for the months of January 2015 through to September 2015 (Argentina Inflation Rate, 2015). The trend created is that of optimism caused by the forthcoming election (Mander, 2015). Therefore, despite the overall relatively bad economy, experts are of the opinion that investors have confidence in Argentina’s economy.

Figure 3. Argentina’s Monthly Inflation Rate for 2015